What Drives Current Inflation?

- Posted By:

Inflation is the economic topic of our time. What are the current inflation drivers? We look at the role of Federal Reserve.

We use the United States to illustrate the concepts. The same mechanisms are at play in many countries.

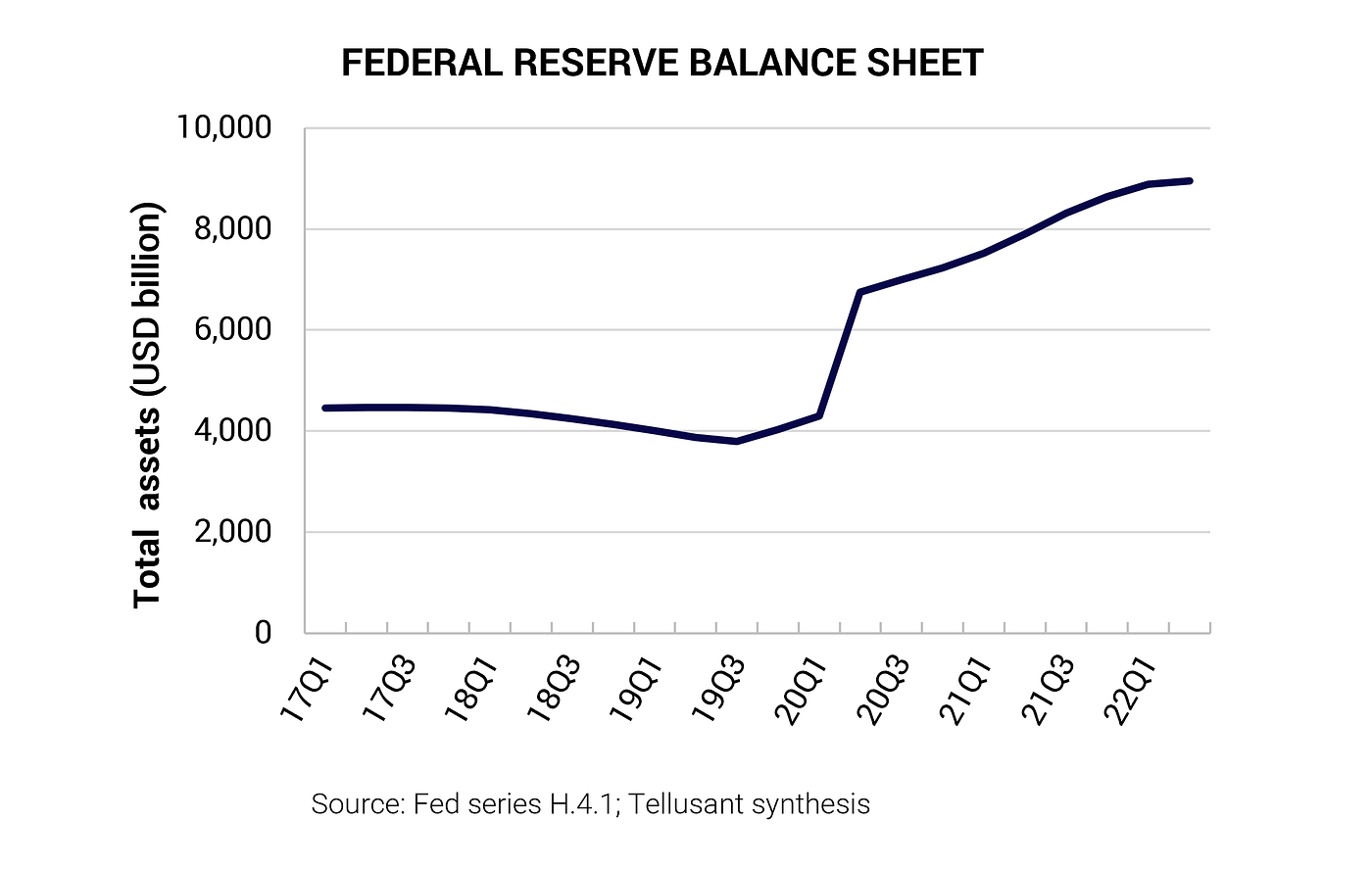

Federal Reserve Actions

Our analysis is based on monetary theory. If you inject money (the M2 measure) into the economy in excess of GDP growth, this will sooner or later lead to inflation.

The Fed has radically increased the M2 (money stock) since 2020. The reason is understandable — to alleviate the impact of the pandemic on the economy. The magnitude is however troublesome.

The mechanism for is that the Fed buys bonds in the market, thereby boosting the size of its balance sheet and injecting cash into the economy. This is largely printed money.

This interview with Jerome Powell, Federal Reserve chair, explains the concept.

The graph below shows the outcome.

M2 money supply

This has a multiplier effect on M2 which has grown broadly proportionally with the Fed’s cash injection.

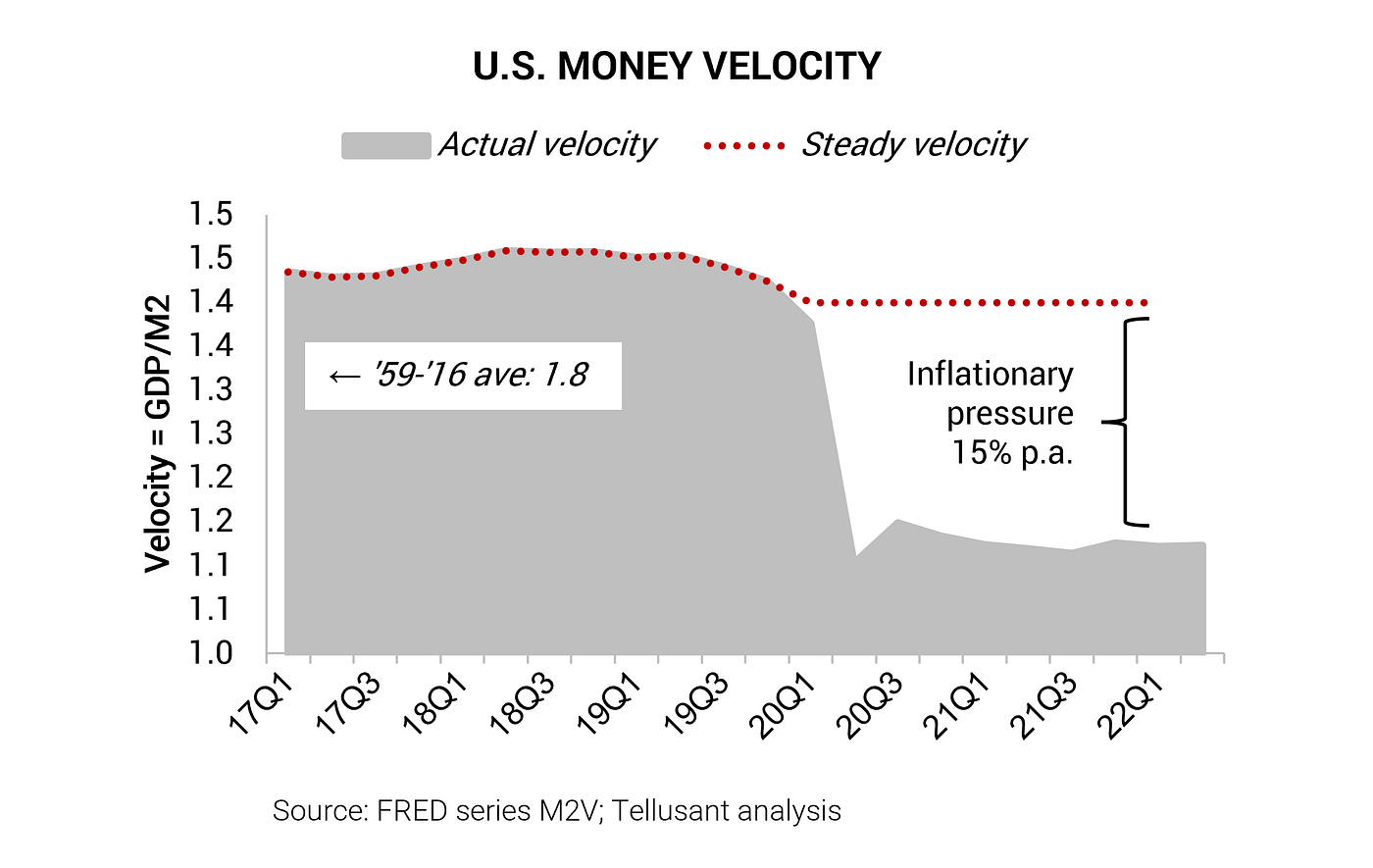

This growth in M2 has only to some extent fueled inflation so far. Instead, the velocity of M2 has slowed dramatically. Historically, M2 velocity has been around 1.8x. Lately it was around 1.4x, and slowed to 1.1x during the pandemic.

Essentially, there is too much money chasing too few investment opportunities. This creates inflationary pressure.

What if M2 velocity had stayed at 1.4x since 2020? This gives an indication of how strong the latent inflationary pressure is.

Calculating backwards from the formula GDP = P⋅Q = M⋅V we get P = 1.4⋅M/Q [P = price; Q = quantity; M = money stock M2] we find:

The latent inflation is around 15% per year since 2020. That is, significantly above the current 9% rate.

From a corporate perspective, it suggests strategic plans should be adjusted to take into account an inflationary environment, and more broadly a wobbly economy.

Understanding the current inflation drivers is a starting point for this.

Tellusant’s expertise and suite of products help companies handle high inflation effectively. To learn more, contact us by filling out this form or by sending an email to info@tellusant.com.

Federal Reserve total assets (H.4.1.1)

M2 (WM2NS)

M2 velocity (M2V)

Current GDP (GDP)