Importance of Income Elasticity

- Posted By:

Importance of Income Elasticity

Income elasticity is one of the most important concepts in strategic planning. Yet few companies or executives use them systematically.

Tellusant’s view: If a company starts to apply income elasticities to expected income growth when predicting the future category demand, it can cut resource allocation mistakes by a quarter.

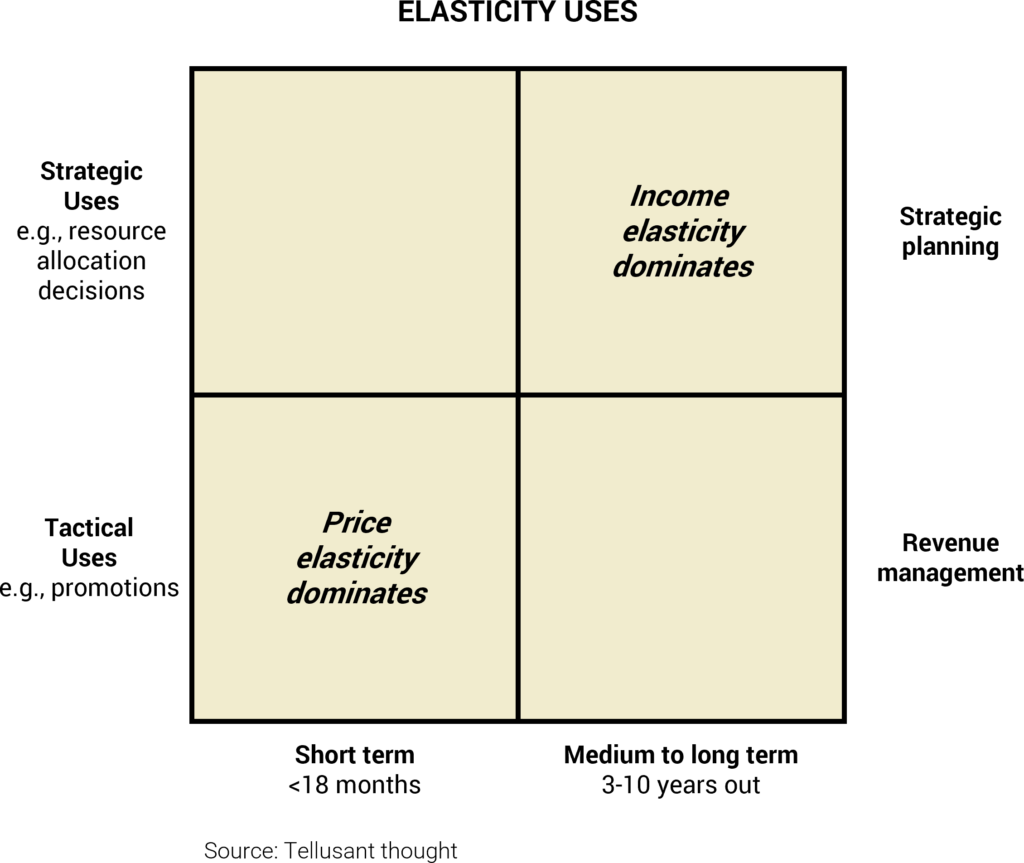

Instead, executives are more familiar with price elasticity. The concepts are the same, but the uses differ. Price elasticity is mainly useful in the short-term and for tactical purposes. The elasticity of income is mainly for the 3-10 year horizon and for strategic purposes.

A few years ago the following happened: In an ExCom meeting in Latin America, we were discussing the income elasticity for a beverage category. Suddenly, an executive jumped in:

— Executive: I don’t get it. Elasticities are negative numbers. But yours are positive. Have you missed the minus sign?

— Dr. Canback: We are talking about income elasticity, not price elasticity.

— Executive, now totally confused: But elasticities deal with prices. What are you talking about?

It is an understandable predicament. If you are used to looking at the world through one lens, making a sudden shift is difficult.

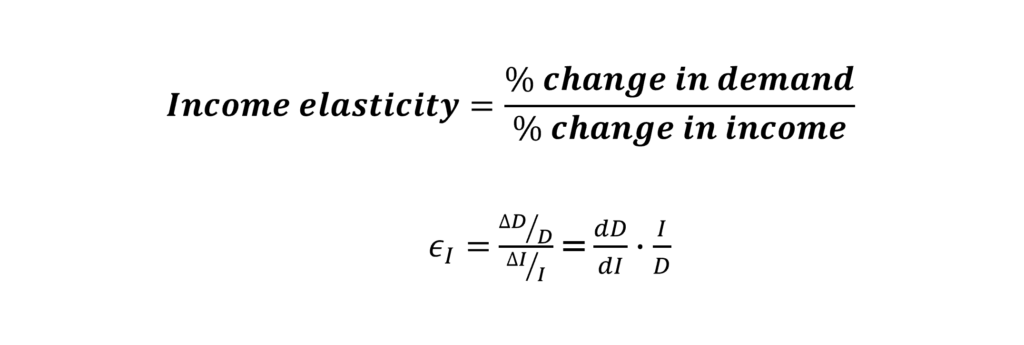

Elasticity is the relative change in a metric (like demand) when something else changes (like income or price). There are thousands of different types of elasticities. For income elasticity: how much does demand go up (in %) if disposable income increases (in %).

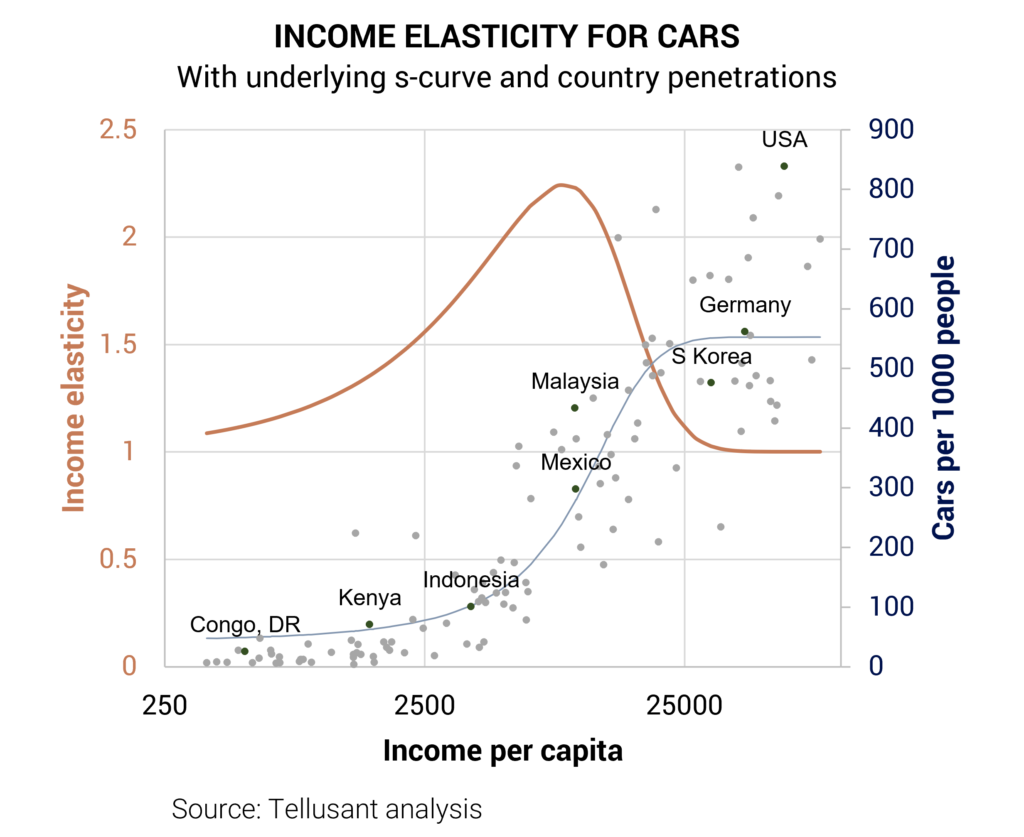

Depending on the affluence in a country, this elasticity varies widely. Look at the graph below for car penetration. Consumers are most responsive at a disposable income per capita of around $8,000 where the elasticity is above 2. That is, if income goes up 1% car penetration increases 2%.

The example here is calculated between countries. If data is available it can also be calculated within countries.

Also, note that the elasticity is related to demand s-curves. (In the case shown here, it is car penetration, not new car sales, so the math is a bit more complicated than usual.)

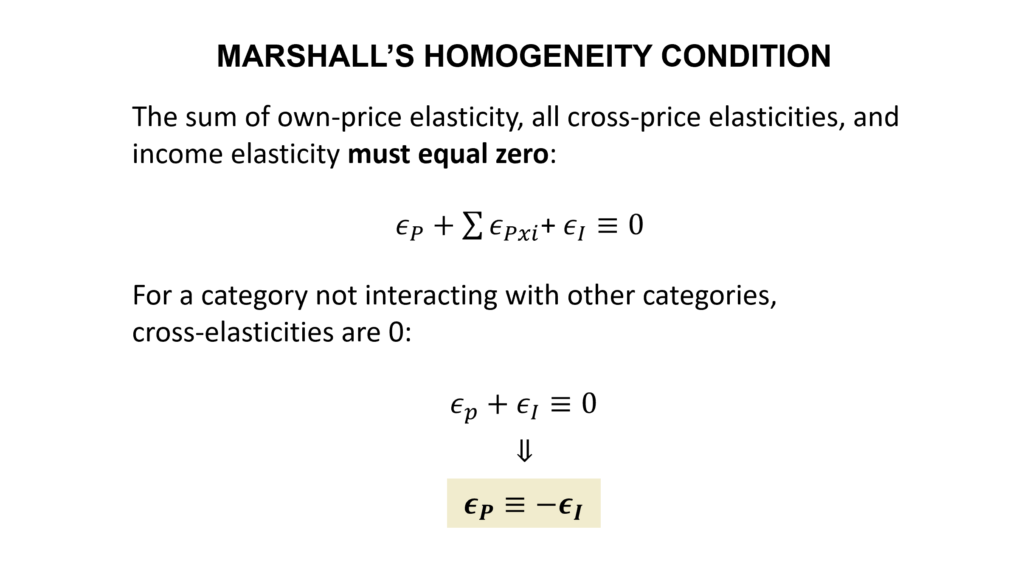

A further aspect of elasticity is that at the category level and with no interaction with other categories

Price elasticity ≡ – Income elasticity.

This is an immensely useful property if price elasticities are not available (e.g., when data are missing). To understand why, look at Marshall’s Homogeneity Condition.

The legendary economist Alfred Marshall noted more than 100 years ago that if income increases x% and price also increases x%, then there should be no change in demand (as common sense tells us). This is Marshall’s homogeneity condition.

• • •

The elasticity of income (combined with income growth) is the single most important factor that determines medium- to long-term category demand. Yet few companies or executives know what it is. This has to be corrected.

To learn more, contact us by filling out this online form or send us an email at info@tellusant.com.

Usage terms: CC BY-NC-ND 4.0

Tellusant's PoluSim product uses the world's most advanced methods for predicting demand by combining income elasticity, income growth, and other factors in a scientifically robust manner.