Managing Through Corporate Crises

- 2022-08-16

- 11:59 am

- Posted By: Tellusant

What should large companies do when experiencing a performance crisis? The answers are situational, but we have a some general observations.

There are the two types of crises:

- Sudden crisis: This is when something bad happens and the crisis is obvious. Examples are lost profitable due to recession or loss of large customer. Meta’s partial loss of the Apple distribution channel is an example.

- Slow-burn crisis: A company is gradually losing its competitive position over several years. Because of the slow deterioration it is not always clear that there is a crisis. GE’s steady decline since 2000 was not obvious initially.

Our key interest is with slow-burn crises. Sudden crises are so obvious that action is almost always taken.

A. How do you identify a slow-burn crisis? I use the rule of thumb: 50% share price decline over the last 5 years.

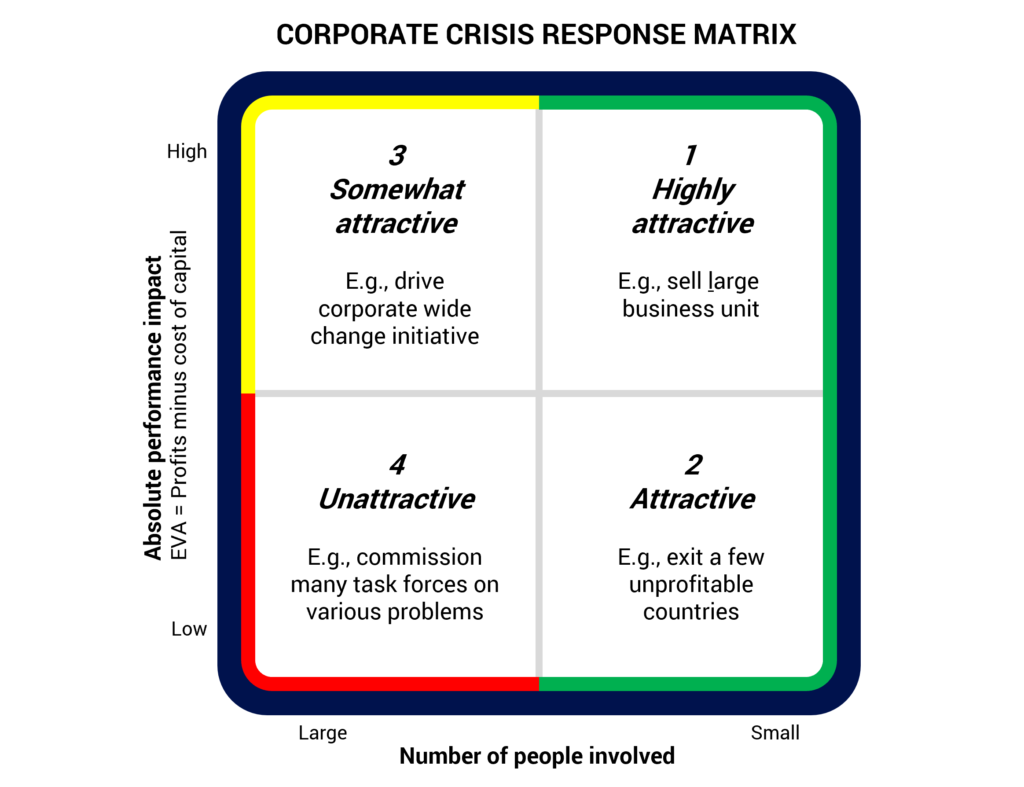

B. What should a CEO do? This gets to the graph below.

Many CEOs start change programs that involve lots of people. This is a terrible starting point.

The key is to take actions that have maximum profit impact and involve as few people as possible since people are averse are change.

- Start with large structural actions that involve few. Sell an entire business. Split up the company. Sell the company to a better owner. And more.

Examples: The Kraft Heinz Company’ sale of its cheese business; GE’s split into three companies; Gillette selling itself to P&G.

- If large opportunities are exhausted, pursue smaller structural actions that involve few. Close a few country subsidiaries (and perhaps use distributors). Close a large but old manufacturing site. Outsource an entire process — never, ever in-source because you think it is less expensive (it never is). And more.

Examples: Target’s closing of its Canada business; General Motors’ closure of multiple plants over the years; Alphabet Inc.’s outsourcing of support services.

- Large corporate-wide change programs may be somewhat attractive because of their potential profit impact. But exhaust #1 and #2 first. Then drive a time-based competition effort. Implement zero-based budgeting. Reorganize. And more.

Examples: ABB’s T50 program; ZBB at Texas Instruments. Procter & Gamble’s reorganization in 2018.

- Avoid myriads of smaller change programs. This is to wrestle with jellyfish and leads nowhere.

Honeywell is an example.

Structural actions inevitably beat people actions during crises. This is in part why M&A investment bankers make more money than management consultants.

• • •

A final observation: Why does this sometimes not happen? In my experience it is usually because of unsuitable owners and poorly functioning boards of directors. So the first action is to address this.

SAS — Scandinavian Airlines is a well known example of dystopic ownership with government and “industrialists” at heart not being interested in performance.

Tellusant’s expertise and suite of products help companies work through crises in a structured manner, utilizing the Corporate Crisis Response Matrix.

To learn more, contact us by filling out this online form.

Usage terms: CC BY-NC-ND 4.0 https://zcu.io/JJTt

Tellusant's strategic planning framework allows

companies to set priorities based on the posts logic.