How to Inflation-Adjust Corporate Revenue Streams

- 2022-08-23

- 11:59 am

- Posted By: Tellusant

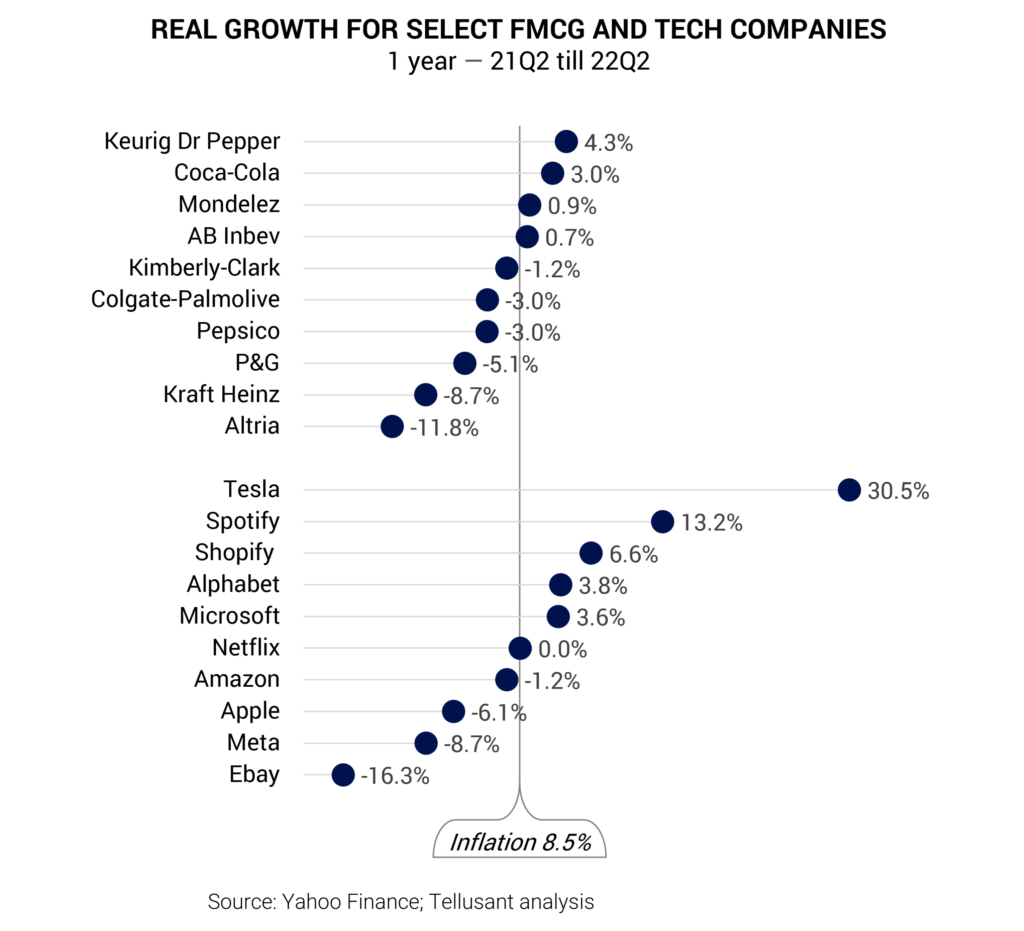

How fast have companies grown over the last year? The real (inflation-adjusted) growth rate is the only way to answer this.

We have previously written about inflation’s impact on corporate management. Inflation-adjusting the top line is the first item on the CEO’s agenda.

How to inflation-adjust revenue? There are two methods:

1. A time-consuming and precise approach: Take revenue in each country and deflate it in local currency with local inflation. Then consolidate by weighting by the size of each country. (An outside analyst cannot use this method since data is unavailable.)

2. A quick and reasonable approach: Take global revenue and deflate it with the home country’s inflation. This works because exchange rates incorporate differential inflation between operating countries and the home country. However, there may be other factors that affect the exchange rate, so this is less precise than method #1.

We use method #2 here, while incorporating the regional mix from quarterly reports.

What do we see? We looked at large FMCG companies and somewhat or largely consumer-oriented tech companies.

The FMCG companies in total shrunk 2.6%. Only four of them beat inflation with Keurig Dr Pepper as the shining star.

The tech companies averaged -0.4%. Tesla had a truly remarkable year. Note the declines of Apple and Meta.

This analysis does not explain why companies grew or shrunk. E.g., Kraft Heinz sold its significant natural cheese business. But for the most part, no such adjustments are not necessary.

In sum, last year was a bad year for FMCG companies and at best a neutral year for tech companies.

• • •

We recommend that CEOs and CFOs intensely monitor the real growth rates and avoid being blinded by nominal growth rates.

To learn more, contact us by filling out this online form.

Usage terms: CC BY-NC-ND 4.0

Tellusant's FoX product includes an inflation module that can be used to adjust the revenue streams, and much more.