Impact of Inflation on Industry Demand (3/5)

- 2022-07-14

- 4:40 am

- Posted By: Tellusant

Should executives make adjustments based on the currently high inflation levels. It seems obvious that the answer is yes. However, the magnitude of response depends on the length of the inflationary period and the impact inflation has on an executive’s industry.

Here we break down this general answer into specific, quantitative metrics for the United States. Other countries differ significantly from this.

Before turning to the analysis, note that we are looking at inflation, not recession. Sometimes these concepts are confounded, which is incorrect. In a separate analysis, we analyzed high inflation’s impact on recession and real income growth and found no systemic link. The correlation, taking into account a lag between inflation and recession, is 0.13 (to be considered very low). [See https://lnkd.in/eXhZFS4P]

Returning to the industry analyses, We now discuss:

- Analysis methods

- Analytical findings

- Conclusions

REVIEW OF INDUSTRY ANALYSIS METHODS

Tellusant collected quarterly inflation and volume data for 188 industries from the Bureau of Economic Analysis. The longest period available goes back to 1947. Industries have 23, 57 or 73 quarters of data.

- A composite analysis was performed on the total sample in a pooled¹ regression (taking into account autoregressive behavior and other subtleties²).

- Industry analyses were done on the 85 industries with 57 or more periods ( to ensure a robust sample).³

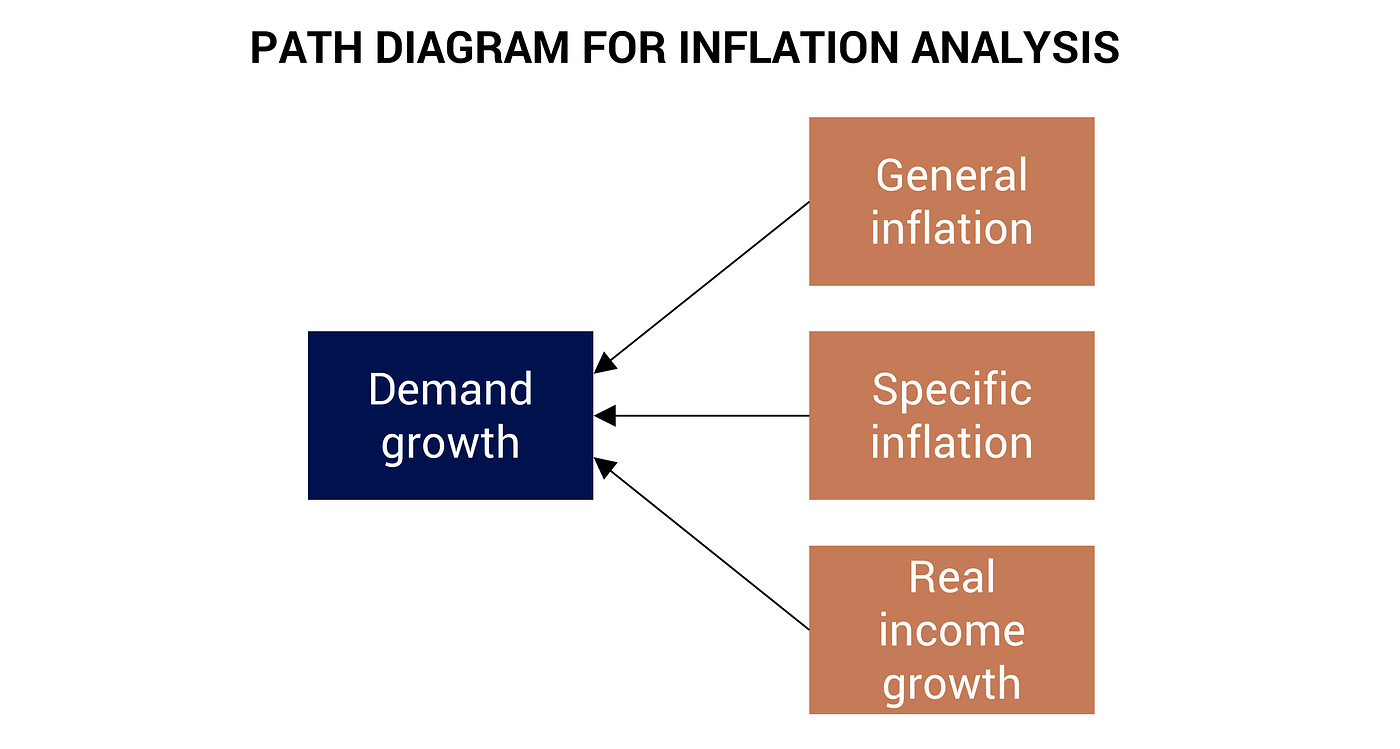

Inflation was divided into two parts:

- General inflation: the inflation affecting the entire U.S. economy

- Specific inflation: the inflation within an industry beyond general inflation

The regression specification⁴ is:

Real income growth controls for the fact that demand may be growing because income increases during inflationary periods (remember from the intro, inflation and income are not correlated).

Note that inflation and price are closely related. Indeed, if industry is narrowly defined as only one product, they are the same.

ANALYTICAL FINDINGS

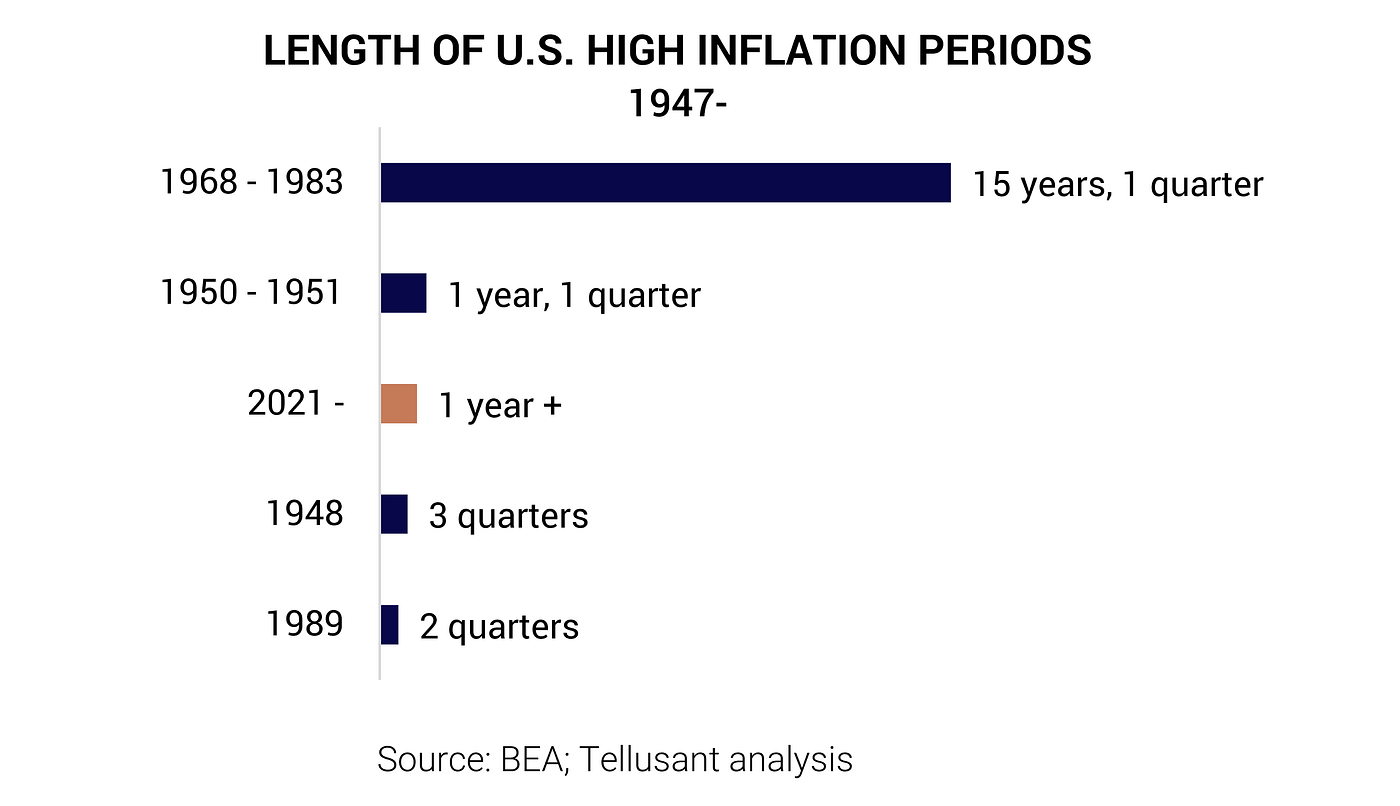

We start by noting that high-inflation periods are rare: there have only been 5 such periods since 1947. They are also short: less than 5 quarters, with the major exception of 15 years from 1968 to 1983.

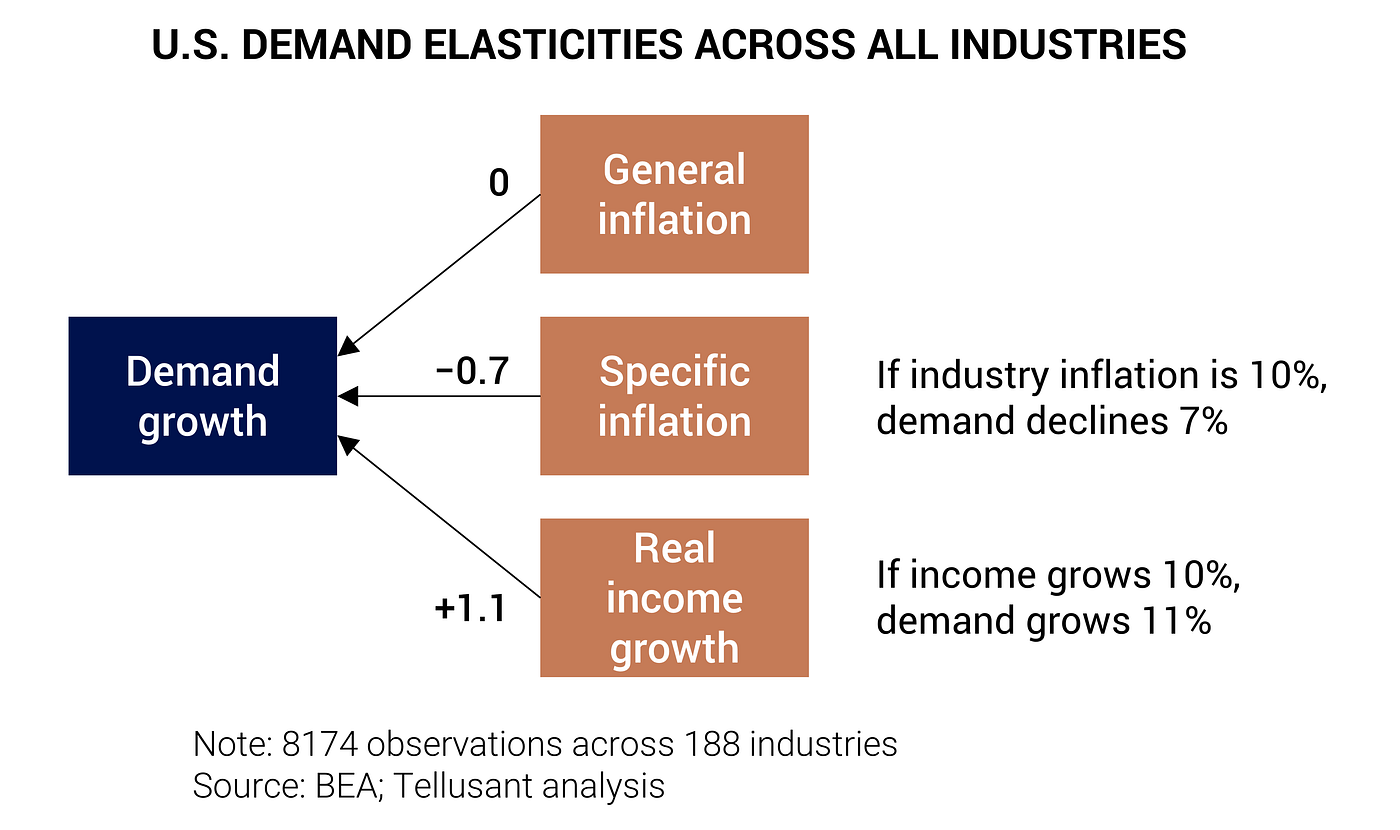

The aggregate analysis of inflation across all industries shows that specific industry inflation has a significant negative impact on demand:

The average specific inflation elasticity should be considered moderate-to-high. When inflation is low, it does not have much impact. But when inflation is high, demand declines significantly.

Over the past several years, inflation was 1.7%. The demand impact on this is -1.1%. But now inflation is 9% and the demand impact is -6.3% on average. This more than 5 percentage points drop is significant.

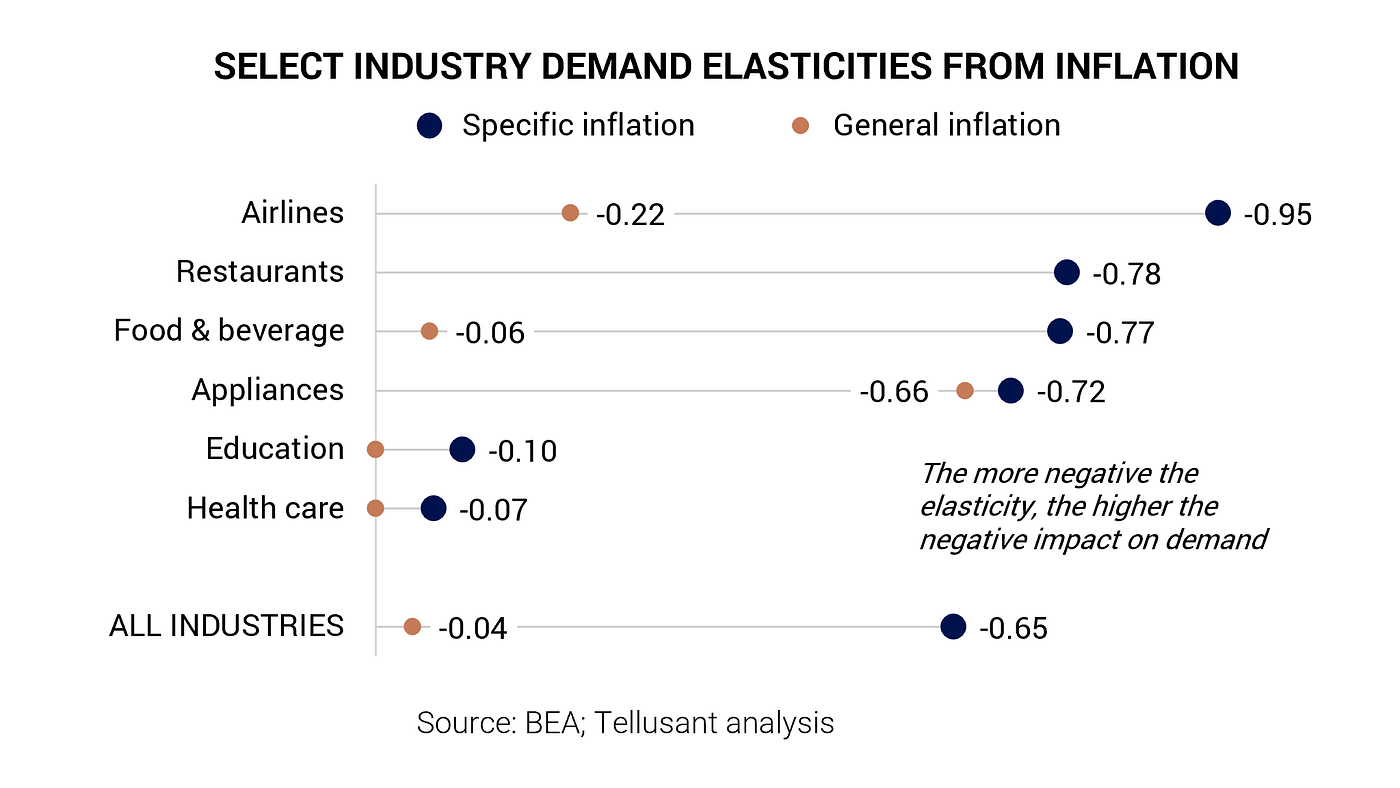

Turning to specific industries, there is considerable variation in outcomes. The graph shows a few select consumer-focused industries from our 85 industry data set.

It is generally the case that specific inflation is more important than general inflation. This means that executives should monitor their industries’ inflation rate, using a fairly broad measure (we recommend the BEA industry classification if such data is available).

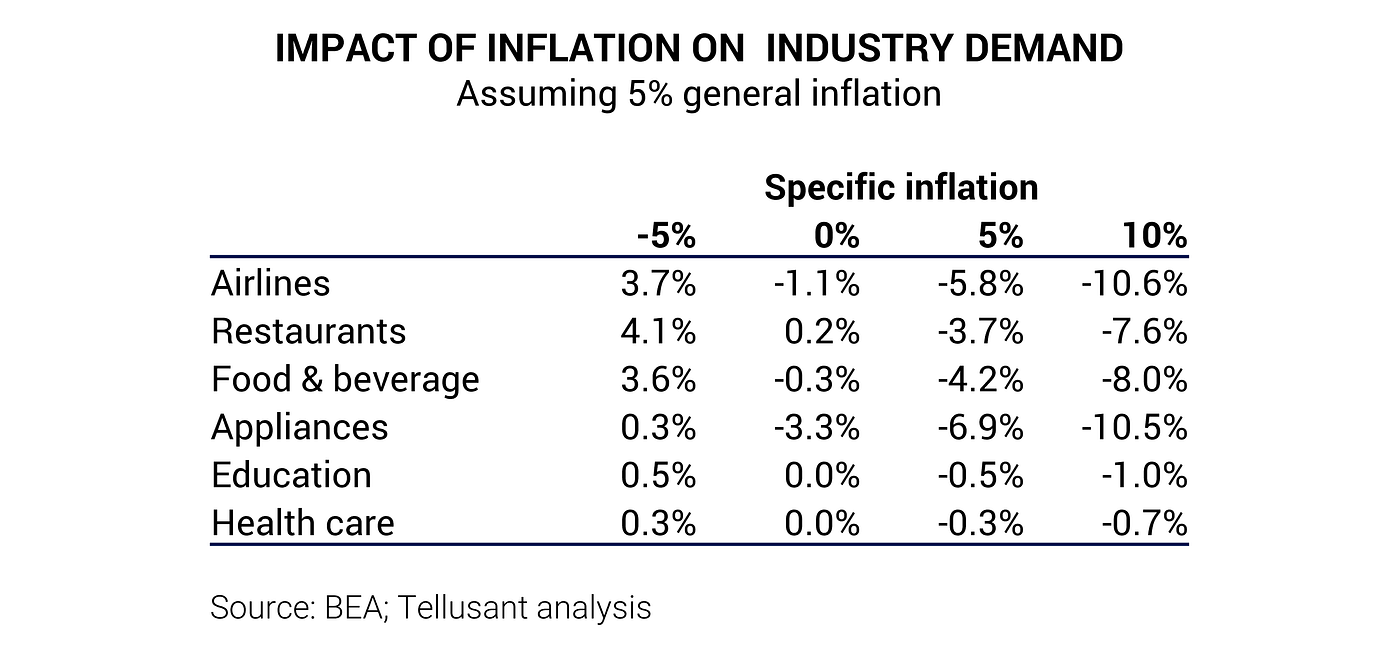

The table below shows a sensitivity analysis for volume demand by applying the above elasticities to the select industries. The impact can be dramatic.

However, this is what all other things equal. Household incomes may still go up, management teams adjust their strategies and tactics, and many other things dampen the impact of inflation. But at its core, inflation has a strong negative impact on demand in many industries.

If high inflation is combined with a recession, then the impact may be truly severe.

CONCLUSIONS

High inflation has a strong negative impact on demand. The impact varies by industry. In consumer goods it is high, in “social” industries, it is low.

It is important for senior executives to track their industries’ specific inflation and not only the general inflation. If their own inflation is high, then corrective actions are required.

Much of the knowledge about inflation is forgotten in the United States. Much can be learned from looking at high-inflation countries within their geographic footprint.

Part 4 in our inflation series covers how to think about pricing in an inflationary environment.

Tellusant’s expertise and suite of products help companies handle high inflation effectively. To learn more, contact us by filling out this online form.

¹ Pooled = cross-sectional / time series analysis

² In Stata terms: ‘xtregar’.

³ In Stata terms: ‘prais’

⁴ With a Cobb-Douglas functional form